Technical Analysis : Hows to Trade Gaps

Gap is a very common market variable used by technical analyst . A Gap is a very important chart pattern without which the study of charts for technical analysis is incomplete . Gaps shows that no trade took place at that certain time . Gaps occur when prices jump in response to sudden imbalance of buy or sell orders . When the open of day 2 is greater than the close of day 1 , it is referred to as Gap Up , similarly when the open of day 2 is lower than the close of day 1 , it is called as Gap Down .

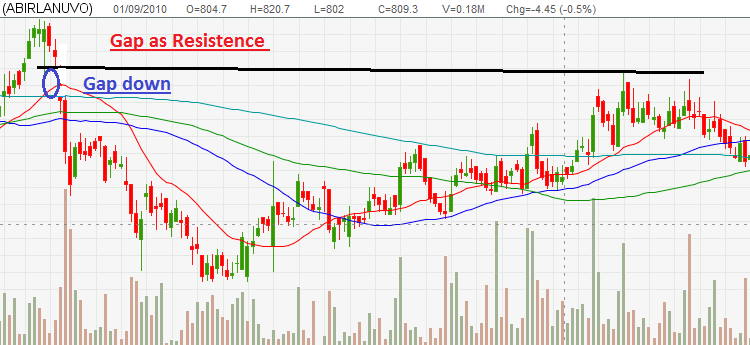

Gaps as Support and Resistance

Gaps can serve as support and resistance levels . If greater volume occurred after an upside gap , it indicates very strong support . If greater volume occurred before the gap , then support is less strong . The reverse is true for resistance levels .

The below chart shows how the gap up level acts as support .

Another chart of ABNuvo shows how the break down level acts as resistance , the price fails to move up the gap down level

How To Trade Gaps

Gaps can occur in the daily chart as well as in the long term charts . Gaps in the long term charts are only considered as valid , each valid gap should have increase in the volume . Gaps are not generally used for day trading . Below are most common rules of gaps trading strategy .

1. Trade when the market breaks out of a long trading range with the increase of volume , If prices have gapped to the upside , buy and place a stop below the lower rim of the gap . If the price have gapped to the down side , sell and place a stop above the upper rim of the gap

2. A valid gap must be confirmed by a series of several new highs or lows. If the prices refuses to reach new highs or lows in the direction of gap , exit your trade .

Technical indicators can help to calculate the price target after the gap has occurred. You can use any charting software for this .

Also see these 5 videos if u want to trade in HIGH ACCURACY :

https://www.youtube.com/watch?v=NqNKQ3Vzn8k (Video 1) Why do all Investors loose money ??

https://www.youtube.com/watch?v=v9zTg3OI7Vg ( Video 2 ) How you can be expert trader yourself ??

https://www.youtube.com/watch?v=oc7l4gmZ71k ( Video 3 ) What is Negative and Positive Divergence ?? How you can profit from it ???

https://www.youtube.com/watch?v=uUUbHWRcz2k (Video 4) GOLDEN RULES for INDIAN STOCK MARKETS - Must Follow to PROFIT

https://www.youtube.com/watch?v=DOyVbKWjMCE ( Video 5 ) Always trade with a PLAN

Do Note I am not Committing you any HUGE GAINS or UNREALISTIC GAINS (Like other do)

ALWAYS KEEP A REALISTIC APPROACH if u want to SURVIVE and GAINS in STOCKS (You probably went for HUGE gains Hence incurred Loss)

If u have any query call me back on +91 9239 176 426

http://www.a1stockoptions.com

No comments:

Post a Comment